Team-Building is Possible With HRDC / HRDF Now!

Human Resource Development Corporation (HRDC), formerly known as Human Resource Development Fund (HRDF), was inaugurated in 1993 to collect levies from registered employers and provide training grants for employee training and upskilling in conjunction with the Pembangunan Sumber Manusia Berhad (PSMB) Act 2001. In its years of operation, HRDC has supported the training and development needs of over 65,450 registered employers, with the numbers still increasing today.

The COVID-19 pandemic from 2020 to 2022 greatly impacted the socio-economic status of Malaysia, and the agency has since expanded its role to support the skills development, employment, and income generation needs of Malaysians across the country. Organizations are encouraged to explore various grants or financing options if their HRDF levy balance is exhausted, ensuring continuous access to training and professional development opportunities.

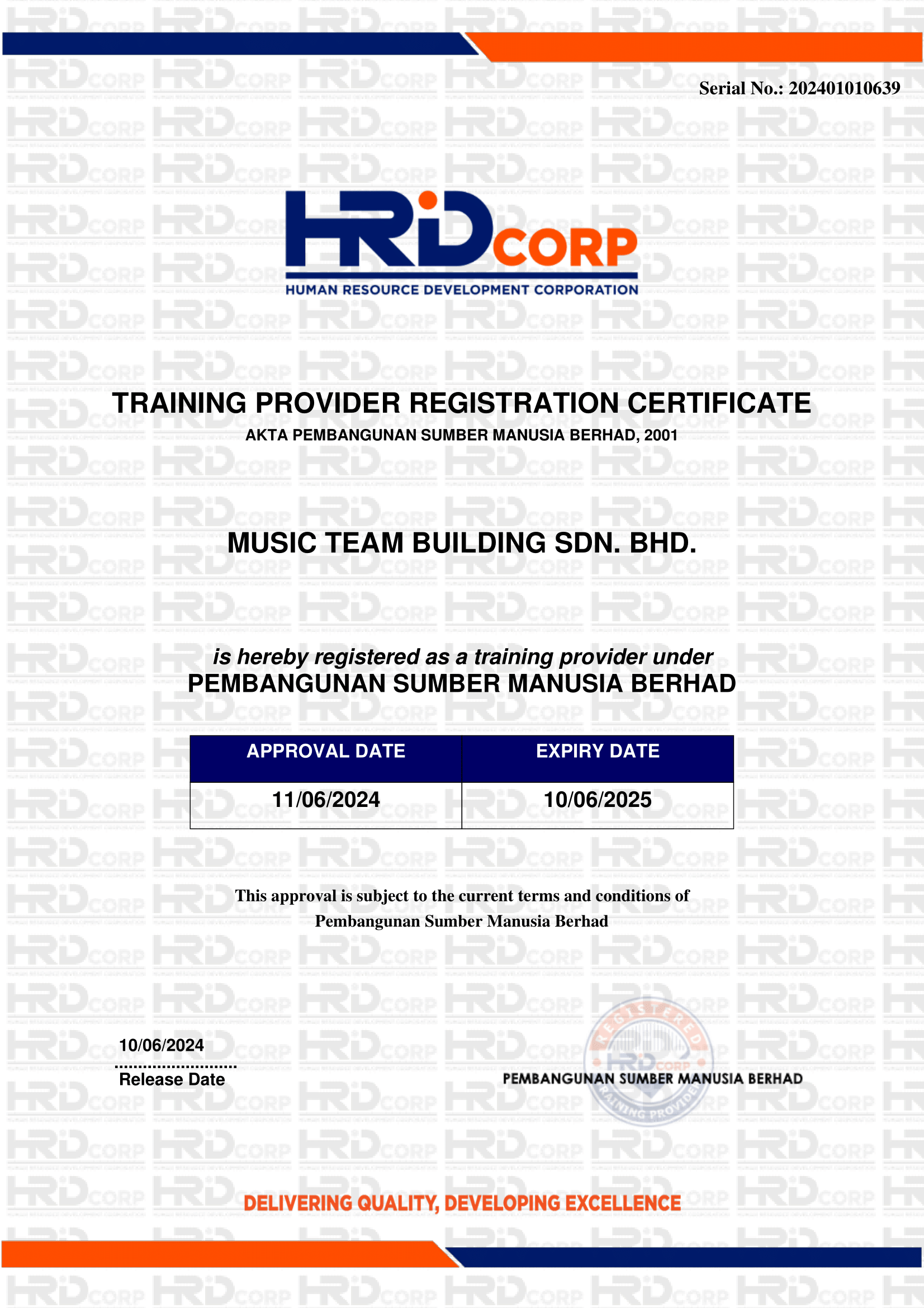

We are proud to announce that as of 11 June 2024, Team Music is an official HRDC Registered Training Provider under the name of Music Team Building Sdn. Bhd. We look forward to working with registered employers to develop their employees’ soft skills and musical creativity!

Key Aspects of HRD Corp Training:

Purpose:

HRD Corp training aims to upskill and reskill the Malaysian workforce by providing employers with access to high-quality training programs. It’s designed to help businesses remain competitive by ensuring their employees have the necessary skills and knowledge.

Training Levy System:

HRD Corp operates through a levy system where eligible employers contribute a percentage of their employees’ wages to a fund. This contribution is then used to finance training programs. Under the Pembangunan Sumber Manusia Berhad Act 2001, employers from specific industries are required to contribute a 1% levy from their payroll for this purpose.

Eligibility:

The program is compulsory for certain industries, but employers from other sectors can also register voluntarily. Eligible companies can claim reimbursement for training programs attended by their employees, provided that the training is recognized by HRD Corp.

Types of Training Programs:

HRD Corp funds various types of training programs, including:

- Skill Development Programs: Focus on enhancing technical skills, such as digital literacy, programming, or specific industry-related skills.

- Soft Skills Development: Includes training in leadership, communication, critical thinking, and problem-solving.

- Certification and Professional Development: Employees can also pursue certifications or professional qualifications through HRD Corp-approved programs.

Training Providers:

HRD Corp collaborates with accredited training providers who offer a wide range of courses. Employers can choose from these providers and claim reimbursement after their employees have completed the training.

Training Grants and Incentives:

HRD Corp offers various financial incentives, including training grants, to employers who invest in their employees’ development. This reduces the financial burden on companies, making it easier for them to participate in upskilling initiatives.

Government’s Vision:

HRD Corp supports the Malaysian government’s vision to develop a high-skilled, knowledgeable workforce that can compete globally. It aligns with the country’s broader goals of improving productivity, innovation, and economic growth.

Key Benefits of HRD Corp Training:

Cost-Effective Training: Employers can claim reimbursement for training, reducing their overall costs while still upskilling their workforce.

Wide Range of Courses: Employers have access to a broad selection of training programs that cover both technical and soft skills, tailored to different industries.

Improved Workforce Competitiveness: By continuously investing in training, companies ensure their workforce is up to date with the latest industry trends and technologies.

Enhanced Employee Satisfaction: Employees benefit from continuous learning and development opportunities, leading to higher job satisfaction, retention, and productivity.

HRDC / HRDF Frequently Asked Questions (FAQ)

1. Is your Programme HRD Corp / HRDF Claimable?

Yes! These are the details of our course:

Organization Name: Music Team Building Sdn Bhd

MyCoID: 202401010639

Scheme Name: HRD Corp Claimable Courses

Course Title: BANDINC – The Growth Mindset Teambuilding Programme

Training Programme No.: 10001433089

HRD Corp Registered Training Provider!

Music Team Building Sdn. Bhd. | 202401010639

2. What is the Program Outline for BANDINC.®?

Please refer to https://www.teammusic.com.my/bandinc/ for more details on BANDINC.® No musical experience needed at all.

3. Where can this training be conducted?

We have done team-building sessions in Kuala Lumpur, Penang, Langkawi, and Ipoh. Malacca and Johor Bahru are now possible as well!

BANDINC. is usually conducted in sound-proofed studios, event venues, and hotel function rooms. We have collaborated with many partners around Malaysia (Johor, KL, Penang) to bring this programme to countless companies.

You can find our regular partners on our home page!

Ruang, Shah Alam, Kuala Lumpur

Affirmative Beats Studio, Penang

4. How do we request a course proposal from you?

- Contact us at https://www.teammusic.com.my/contact-us/

- We will email these to you:

- BANDINC. Course Proposal

- BANDINC Song List

- HRDC Trainer Info

- Experienced Foreign Trainers’ Information

5. What are the claims and expenses?

a. Course Fees for your team pax size

–RM6000 for every batch of 35pax in a team

1) Please request an upfront payment maximum of 30% of the total course fee from HRD Corp Training, to be payable to Music Team Building Sdn Bhd

2) Please request a final payment of 70% of the total course fee from HRD Corp Training, to be payable to Music Team Building Sdn Bhd, upon completion of training.

b. Trainees’ Allowance

-Up to RM150 per pax for distances less than 100km to training location from home/office

1) Please pay 50% of the trainee allowance as confirmation of the entire training. We will book all venue, equipment, and meals with this amount.

2) Please pay 50% of trainee allowance, upon completion of the training.

c. Overseas Trainer Allowance

-Up to RM400 for each foreign trainer

1) Please pay 50% of the trainee allowance as confirmation of the entire training. We will book all venue, equipment, and meals with this amount.

2) Please pay 50% of trainee allowance, upon completion of the training.

6. What additional documents do I need to submit claims?

T3 ATTENDANCE FORM

JD14 – EMPLOYER AND TRAINING PROVIDER JOINT DECLARATION FOR SBL-KHAS SCHEME CLAIMS (FEES)

7. Is HRDC the same as HRDF?

In April 2021, HRD Corp (HRDC) underwent a name change from HRDF, marking a shift towards a broader focus that includes upskilling and reskilling initiatives for all Malaysian employers and individuals.

This was highly encouraged through the PSMB Act 2001, to provide training and enhance the skills of their local employees, apprentices, and trainees in alignment with the rapidly changing global business environment, while also meeting the goals of their respective company/companies.

8. What is the PSMB Act 2001?

PSMB 2001 is a legislation aimed at implementing and collecting a human resources development (HRD) levy to foster the training and advancement of employees, apprentices, and trainees. It includes provisions for the establishment and management of the Fund by the Corporation, along with related matters.

9. Why Choose Music Team Building as your HRDC Training Provider

1) 100% Claimable – Our training modules and programmes are 100% HRDC claimable, which enables participants from any organisations to apply for the grant. Train your employees at zero-out-of-pocket.

2) Trusted globally

3) With our range of expertise, we provide customised learning that can cater to your organisation’s training needs.

4) Our support team will be available to help you through your claim process when attending our HRDC claimable modules and programmes.

10. HRDC Eligibility Requirements For Employers

Employers Registered with PSMB

Employers registered and / or incorporated in Malaysia who have registered with PSMB under the Suruhanjaya Syarikat Malaysia (SSM) or Registrar of Society (ROS) – with either one of the following status:

- Berhad (Bhd.) / Sendirian Berhad (Sdn. Bhd.)

- Limited Liability Partnership (LLP)

- Sole Proprietor / Enterprise

- Association

- Government / Semi Government Institution Training Programmes Beneficial to Business Operations

Training must be in the area of direct benefit to their business operations. Financial assistance is, therefore, not given to individuals who enrol and finance their own training programmes, whether partially or fully, and subsequently request their employers for sponsorship. Neither is financial assistance given to employers who bear the cost of training after the successful completion of training by their employees.

Malaysian Citizens

To be eligible for training grants under the HRDF, trainees must be employees who are Malaysian citizens.

11. How to register for HRDC Training?

To register for HRDC training under the Human Resource Development Corporation (HRD Corp) in Malaysia, both employers and training providers need to follow specific steps to ensure compliance and access to HRD Corp’s training benefits. Below is a guide on how to register for HRDF training.

For Employers:

Employers in specific industries are required to register with HRD Corp to be eligible for the training levy system. Here are the steps for employers:

1. Check Eligibility

-

Confirm if your company is part of the sectors required to register under HRD Corp. Sectors like manufacturing, services, and mining/quarrying are often covered.

-

If your company doesn’t fall under the compulsory sector, you may still opt for voluntary registration to benefit from training opportunities.

2. Complete the Registration Process

-

Online Registration: Visit the official HRD Corp portal at https://hrdcorp.gov.my/.

-

Go to the Registration section and select Employer Registration.

-

Fill in the required information, including company details, business registration number, sector, and total number of employees.

-

You may be asked to upload documents such as your SSM (Companies Commission of Malaysia) registration documents or other business certifications.

3. Submit Your Registration

-

After filling in all the details and uploading necessary documents, submit your registration. The HRD Corp team will review your application.

-

Once your registration is approved, your company will be assigned an HRD Corp account.

4. Contribute to the Training Levy

-

As a registered employer, you are required to contribute 1% of your monthly payroll into the HRD Corp fund. The contribution is applicable to employees who are Malaysian citizens.

-

The levy is mandatory for eligible sectors, and this amount can be claimed back when you send employees for approved training programs.

5. Choose a Training Program

-

After registering, employers can select HRD Corp-approved training programs from accredited training providers.

-

Employers can find the list of accredited training providers and approved programs via the HRD Corp e-TRiS (Electronic Transaction of Information System) portal.

6. Claim Training Costs

-

Once your employees complete the training, you can submit a claim through the HRD Corp e-TRiS portal for reimbursement. You will need to provide the necessary documentation, such as proof of employee attendance and invoices from the training provider.